Switzerland, renowned for its picturesque landscapes, precision in watchmaking, and robust economy, stands out as an attractive destination for businesses looking to expand their operations. When venturing into the Swiss job market, employers must understand the unique aspects of the country’s employment landscape. This guide provides a comprehensive overview of the essential considerations and steps in hiring employees in Switzerland.

Understanding Switzerland’s Legal Framework

Switzerland boasts a well-defined legal framework governing employment practices, ensuring fair treatment of both employers and employees. Before embarking on the hiring process in this European nation, it is crucial to comprehend the legal intricacies that shape the employment landscape. Below are key aspects to consider:

1. Employment Contracts and Terms:

In Switzerland, employment contracts serve as the cornerstone of the employer-employee relationship. These contracts must outline essential details such as working hours, salary, benefits, and termination clauses. It is imperative to adhere to Swiss regulations regarding minimum wage, overtime, and other employment conditions specified in the Swiss Code of Obligations.

2. Work Permits and Foreign Nationals:

Hiring foreign nationals requires adherence to Swiss immigration laws. Employers must obtain valid work permits for non-Swiss employees. The specific requirements may vary based on the employee’s nationality, qualifications, and the duration of their intended stay. Familiarity with the Swiss Federal Act on Foreign Nationals is essential for compliance.

3. Data Protection and Privacy:

Switzerland is stringent when it comes to data protection and privacy. Employers must comply with the Federal Data Protection Act, ensuring that personal and sensitive employee information is handled securely. Consent for data processing, especially for background checks, must be obtained in accordance with Swiss regulations.

4. Social Security Contributions:

Employers and employees alike are obligated to contribute to the Swiss social security system. Understanding the intricacies of these contributions, including pension, disability, and health insurance, is vital. Compliance with the Swiss social security system ensures that employees receive the necessary benefits while maintaining legal compliance for employers.

5. Working Hours and Leave Entitlements:

Swiss labor laws dictate specific regulations regarding working hours, breaks, and leave entitlements. Employers must adhere to these guidelines, which include restrictions on maximum working hours, mandatory rest periods, and annual leave. Understanding and implementing these regulations contribute to a healthy work-life balance for employees.

6. Termination Procedures and Severance:

The termination of employment in Switzerland is subject to well-defined procedures and regulations. Notice periods, severance pay, and grounds for termination are specified in the employment contract and further regulated by Swiss labor laws. Complying with these regulations is essential to avoid legal disputes and ensure a fair termination process.

7. Collective Labor Agreements:

Some industries in Switzerland may have collective labor agreements (CLAs) in place. These agreements, negotiated between employers and trade unions, may establish additional terms and conditions beyond statutory requirements. Employers should be aware of any applicable CLAs within their sector and ensure compliance.

8. Equal Opportunity and Non-Discrimination:

Switzerland places a strong emphasis on equal opportunity and non-discrimination in the workplace. Employers must adhere to the Federal Act on Gender Equality and other relevant legislation to prevent discrimination based on gender, nationality, religion, or other protected characteristics.

How to Hire Employees in Switzerland?

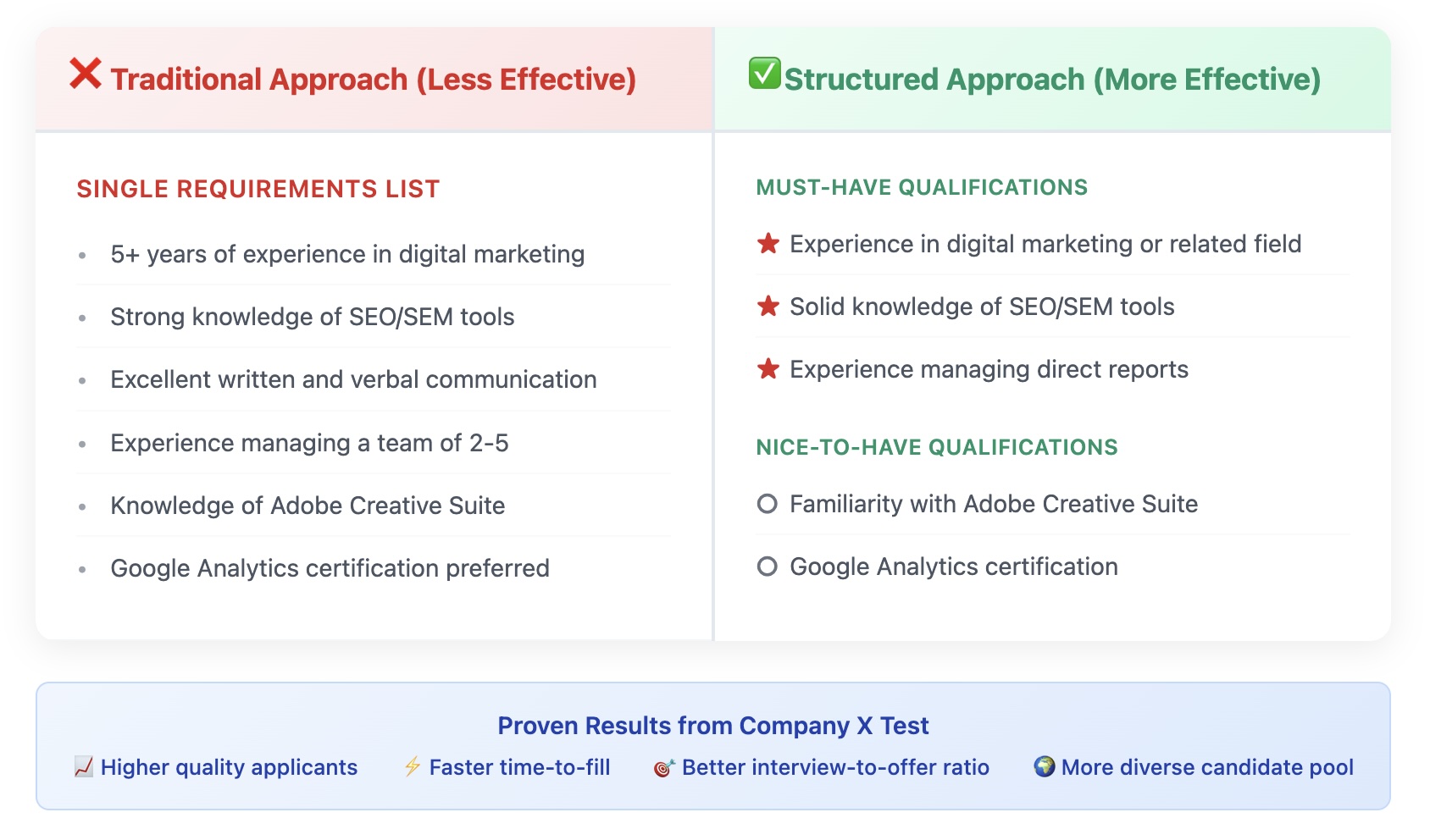

1. Job Posting and Advertisement:

In Switzerland, the hiring process typically begins with the creation of a detailed job posting. This document outlines the role’s responsibilities, qualifications, and other essential details. Companies often utilize various channels for advertising job vacancies, including online job portals, company websites, and professional networks. It is common for organizations to adhere to the principles of transparency and equality, ensuring that job advertisements provide clear and unbiased information.

2. Application and Resume Review:

Once job applications are received, the next step in the hiring process involves the thorough review of resumes and cover letters. Swiss employers prioritize a candidate’s educational background, professional experience, and relevant skills. The emphasis on precision and attention to detail is reflected in the meticulous examination of application materials. Additionally, many companies in Switzerland appreciate a well-structured and concise CV, which adheres to the local standards.

3. Initial Screening and Shortlisting:

After the initial review, qualified candidates are shortlisted for an initial screening process. This may involve a preliminary interview conducted over the phone or via video conferencing. The purpose of this stage is to assess the candidate’s compatibility with the role and the organization. Swiss employers often look for individuals who not only possess the required technical skills but also demonstrate cultural fit, adaptability, and a strong work ethic.

4. In-Person Interviews:

Successful candidates from the initial screening are invited for in-person interviews. Interviews in Switzerland are conducted rigorously, with an emphasis on assessing both technical competencies and soft skills. Hiring managers may use behavioral questions to understand how candidates have handled specific situations in the past. In addition, there is often a focus on cultural alignment, as Swiss companies value a collaborative and team-oriented work environment.

5. Assessment and Testing:

Some employers in Switzerland incorporate assessments and testing into their hiring process. This could involve technical skills assessments, psychometric tests, or other job-specific evaluations. These assessments aim to provide a more comprehensive understanding of a candidate’s abilities and suitability for the role.

6. Reference Checks:

Before extending a job offer, Swiss employers often conduct thorough reference checks. This step involves contacting previous employers or professional contacts provided by the candidate to verify the accuracy of the information provided and gain insights into the candidate’s work ethic and performance.

7. Job Offer and Negotiation:

Upon successful completion of the interview and reference check stages, the selected candidate is presented with a job offer. Negotiations regarding salary, benefits, and other terms of employment may take place at this point. Swiss companies value transparency and open communication during this stage to ensure a mutually beneficial agreement.

8. Onboarding:

Once the candidate accepts the job offer, the onboarding process begins. Swiss companies typically prioritize a comprehensive onboarding program to help new hires integrate into the organization seamlessly. This may include introductions to team members, training sessions, and an overview of company policies and procedures. The goal is to facilitate a smooth transition for the new employee into their role and the company culture.

Interviewing Process in Switzerland

-

Application and Resume Screening:

The interviewing process in Switzerland typically begins with the submission of a comprehensive application and a well-crafted resume. Swiss employers place significant importance on the quality of written applications, and attention to detail is crucial. A strong emphasis is placed on academic achievements, relevant work experience, and language proficiency, especially in regions with multiple official languages such as German, French, and Italian.

-

Initial Contact and Pre-screening:

Once the application is received, it is common for employers in Switzerland to conduct an initial pre-screening interview over the phone or via video conferencing. This allows the employer to assess the candidate’s communication skills, motivation, and cultural fit within the organization. It’s important for candidates to be well-prepared for this stage and demonstrate a clear understanding of the company and the role they are applying for.

-

Assessment Centers and Testing:

In Switzerland, some companies may utilize assessment centers as part of the interviewing process, especially for roles requiring specific skills or competencies. These centers often include a series of tests, group activities, and individual exercises designed to evaluate problem-solving abilities, teamwork, and leadership skills. Candidates may also be asked to undergo psychometric assessments or technical tests depending on the nature of the position.

Face-to-face interviews are a key component of the Swiss interviewing process. These interviews may be conducted by multiple interviewers, including HR professionals, hiring managers, and potential team members. The atmosphere is typically professional and structured, with a focus on competency-based questions that assess the candidate’s ability to handle specific job-related situations. Swiss employers value honesty and directness, so candidates are encouraged to communicate openly about their experiences and skills.

-

Language Proficiency Evaluation:

Given Switzerland’s multilingual environment, language proficiency is a critical aspect of the interviewing process. Depending on the region and the language requirements of the job, candidates may be assessed in multiple languages. For international roles, English proficiency is often a prerequisite. Clear and effective communication in the relevant languages is essential for success in the Swiss job market.

-

Reference Checks and Background Verification:

Once a candidate successfully progresses through the interview stages, Swiss employers often conduct thorough reference checks and background verifications. This may include contacting previous employers, academic institutions, and other professional references to validate the candidate’s qualifications and work history. Candidates should ensure their references are readily available and well-informed about their skills and experiences.

Upon successful completion of the interviewing process, the employer may extend a job offer. Salary negotiations are a common part of this stage, and candidates are expected to approach these discussions professionally. Swiss employers appreciate a well-researched and reasonable negotiation, keeping in mind the local market standards and industry norms.

Onboarding Process in Switzerland

By following this onboarding process, we aim to ensure that you have a positive and productive start to your career with us in Switzerland. Welcome to the team!

-

Welcome and Introduction:

Upon joining our organization in Switzerland, you will be warmly welcomed by our HR team or designated personnel. During the initial onboarding session, you will receive a comprehensive introduction to the company’s history, values, and mission. We believe in fostering a collaborative and inclusive work environment, and this introduction will help you understand how your role contributes to our overall success.

-

Legal and Administrative Procedures:

Switzerland has specific legal and administrative requirements for employment. During the onboarding process, you will be guided through the necessary paperwork, including the completion of employment contracts, tax forms, and any other relevant documents. Our HR team will be available to answer any questions and ensure a smooth transition into your new position.

-

Company Policies and Compliance:

To ensure a clear understanding of our expectations, you will receive detailed information about the company policies and guidelines. This includes information on working hours, communication protocols, data protection, and any other relevant policies. Our commitment to compliance is crucial, and we encourage open communication to address any concerns or queries you may have.

We understand the importance of employee well-being, and as part of your onboarding process, you will receive a thorough explanation of the benefits and perks offered by our organization. This includes information about health insurance, pension plans, vacation policies, and any other additional benefits that contribute to your overall satisfaction and work-life balance.

-

Training and Development:

Continuous learning is integral to our organizational culture. During the onboarding process, you will be introduced to our training and development programs. Whether it’s on-the-job training, workshops, or professional development courses, we are committed to helping you enhance your skills and reach your career goals within the company.

Building strong working relationships is a key aspect of our corporate culture. You will have the opportunity to meet your colleagues and team members, fostering a sense of camaraderie and collaboration. Team-building activities and events will be organized to help you integrate seamlessly into the company culture.

-

Workplace Tools and Technology:

Efficient use of technology is crucial in today’s workplace. You will receive comprehensive training on the tools and technologies relevant to your role. This includes an overview of our internal communication platforms, project management tools, and any other software necessary for your daily tasks.

-

Performance Expectations and Feedback:

Clear communication about performance expectations is essential. During your onboarding, you will have a discussion with your manager to outline goals and expectations for your role. Additionally, we believe in providing regular feedback to help you thrive in your position and contribute effectively to the success of the team and the organization.

Payroll and Taxes in Switzerland

In Switzerland, payroll and taxes are governed by a complex system of regulations and laws. The Swiss tax system is decentralized, with each canton (region) having its own tax rates and rules. Here is a general overview of the payroll and tax system in Switzerland:

1. Income Tax:

- Federal Income Tax: Switzerland has a federal income tax system, and tax rates vary based on income levels. The rates are progressive, meaning higher incomes are taxed at higher rates.

- Cantonal and Municipal Income Tax: Each canton and municipality has its own income tax rates, deductions, and allowances. These rates can significantly differ between regions.

2. Social Security Contributions:

- Old Age and Survivors’ Insurance (OASI): Both employers and employees contribute to OASI. The contributions are calculated as a percentage of the employee’s salary, up to a certain income threshold.

- Disability Insurance (DI): Similar to OASI, contributions to the Disability Insurance are made by both employers and employees.

- Unemployment Insurance (UI): Contributions to the Unemployment Insurance are also shared between employers and employees.

3. Health Insurance:

- Health insurance is mandatory for all residents in Switzerland. Individuals are responsible for obtaining their coverage, and the premiums vary based on the chosen insurance provider and coverage options.

4. Withholding Tax:

- Employers are required to withhold taxes from employees’ salaries and remit them to the tax authorities. The withholding tax is an estimate based on the employee’s expected annual income.

5. Employer Payroll Taxes:

- Employers are responsible for various social security contributions, including those for accident insurance, family allowances, and additional cantonal or municipal taxes.

6. Tax Reporting:

- Employers are required to provide annual tax certificates to employees summarizing their income and taxes withheld during the year.

7. Tax Deductions:

- Employees may be eligible for various tax deductions, such as contributions to pension funds, certain insurances, and professional expenses.

8. Expatriate Taxation:

- Expatriates may be subject to special tax rules, and it’s crucial to consider any tax treaties that Switzerland may have with the expatriate’s home country.

9. Compliance and Reporting:

- Employers must comply with local and federal regulations regarding payroll and tax reporting. This includes submitting annual reports, ensuring accuracy in calculations, and staying updated on any changes in tax laws.

Types of Employment Contracts in Switzerland

In Switzerland, employment contracts are governed by both statutory regulations and individual agreements between employers and employees. The country’s labor market adheres to a high level of protection for workers, ensuring fair and equitable employment conditions. Various types of employment contracts are prevalent, each catering to specific employment arrangements and conditions.

1. Open-Ended Contracts:

The most common type of employment contract in Switzerland is the open-ended or indefinite-term contract. This arrangement establishes an ongoing employment relationship without a specified end date. Both parties enjoy flexibility, and termination typically requires adherence to notice periods outlined in Swiss labor law. Open-ended contracts offer job security to employees and allow employers to adapt to changing business needs.

2. Fixed-Term Contracts:

Fixed-term contracts are employed when there is a specific project, seasonal work, or temporary need. These contracts have a predetermined duration, and the employment relationship automatically concludes upon reaching the agreed-upon end date. Employers must provide valid reasons for using fixed-term contracts, such as temporary workload fluctuations or specific project requirements.

3. Part-Time Contracts:

Part-time employment contracts are prevalent in Switzerland, offering flexibility for both employers and employees. Individuals under part-time contracts work fewer hours than full-time employees, and their rights are protected by labor laws. This type of contract suits individuals seeking a better work-life balance or those with other commitments such as studies or family responsibilities.

4. Temporary Agency Work Contracts:

Temporary agency work involves an arrangement where an employee works for a staffing agency and is then placed temporarily with client companies. The staffing agency is the employer and handles administrative responsibilities, while the worker provides services to various clients. Swiss law regulates this type of employment to ensure fair treatment and protection for temporary agency workers.

5. Apprenticeship Contracts:

Switzerland places a strong emphasis on vocational training through apprenticeships. These contracts are typically fixed-term and involve a combination of on-the-job training and classroom education. The apprentice learns a specific trade or profession under the guidance of a qualified mentor. Apprenticeship contracts play a crucial role in shaping the skilled workforce and are supported by both the government and businesses.

6. Freelance and Independent Contractor Agreements:

Freelancers and independent contractors work on a project basis and are not considered traditional employees. They provide specific services under a contract, with terms outlining deliverables, payment, and other relevant details. While they enjoy a degree of independence, both parties must carefully define their expectations to ensure a clear understanding of the working relationship.

What is the 13 salary in Switzerland?

In Switzerland, the 13th salary, also known as the “13th month” or “Christmas bonus,” is a unique compensation feature that sets the country apart in its approach to employee remuneration. Unlike many other nations, where employees typically receive their annual salary divided into 12 monthly payments, Switzerland embraces the concept of a supplementary 13th salary, providing an extra boost to employees’ income.

- Purpose and Significance: The primary purpose of the 13th salary in Switzerland is to help employees manage increased expenses during the festive season, particularly around Christmas and New Year. This additional payment serves as a financial cushion, allowing individuals to cover holiday-related costs, such as gifts, travel, and celebrations. For many Swiss workers, the 13th salary represents a tangible expression of employer appreciation and support during a time traditionally associated with family and generosity.

- Calculation and Distribution: The 13th salary is typically calculated as an additional month’s salary, equivalent to one-twelfth of the employee’s annual gross income. Employers may distribute this bonus in different ways – some pay it out as a lump sum in December, while others may divide it into smaller installments throughout the year. The precise method of distribution can vary depending on the employer’s policies and the employment contract.

- Legal Framework and Employer Practices: While the 13th salary is not mandatory under Swiss law, it has become a common and widely accepted practice among employers in the country. Many employment contracts explicitly outline the conditions and timing of the 13th salary payment, ensuring transparency and clarity for both parties. Some collective labor agreements or industry standards may also stipulate the provision of a 13th salary.

- Impact on Employment Relationships: The inclusion of a 13th salary in employment packages contributes to the overall job satisfaction of employees in Switzerland. It fosters a sense of financial security and recognition, which can positively influence the employer-employee relationship. The practice also aligns with the Swiss commitment to maintaining a high standard of living for its workforce, further solidifying the country’s reputation for valuing the well-being of its citizens.

Employee Benefits in Switzerland

Employee benefits in Switzerland go beyond the basics, reflecting the country’s commitment to a high quality of life, work-life balance, and employee well-being. From comprehensive health coverage to robust retirement plans and flexible work arrangements, these benefits contribute to a positive and fulfilling work experience for employees in Switzerland.

- Health Insurance: In Switzerland, employee benefits often include comprehensive health insurance coverage. The country’s healthcare system is renowned for its high quality, and employers typically contribute significantly to their employees’ health insurance premiums. This coverage extends to both basic medical needs and specialized treatments, ensuring that employees have access to a broad range of healthcare services.

- Pension Plans: Switzerland places a strong emphasis on retirement planning, and many employers offer pension plans as part of their employee benefits package. The mandatory occupational pension system, known as the second pillar, requires employers to contribute to their employees’ pension funds. This ensures that employees can enjoy financial security during their retirement years.

- Vacation and Paid Time Off: Work-life balance is highly valued in Switzerland, and employees often enjoy generous vacation allowances and paid time off. It is common for employees to receive a minimum of four weeks of paid vacation per year, allowing them to recharge and spend quality time with family and friends. Additionally, the country observes numerous public holidays, providing employees with additional time for relaxation and personal pursuits.

- Maternity and Paternity Leave: Switzerland recognizes the importance of family life, and employee benefits often include provisions for maternity and paternity leave. Mothers typically receive 14 weeks of maternity leave, with a portion of their salary covered by social insurance. Fathers can also take paternity leave, allowing them to actively participate in the early stages of parenthood.

- Training and Professional Development: To foster continuous learning and career growth, many Swiss employers invest in training and professional development opportunities for their employees. This may include workshops, courses, and seminars that enhance skills and knowledge relevant to the employee’s role. Additionally, employers may support further education, encouraging employees to pursue advanced degrees or certifications.

- Flexible Work Arrangements: Switzerland recognizes the importance of flexible work arrangements in promoting a healthy work-life balance. Many employers offer flexible working hours, part-time options, and remote work possibilities. This flexibility accommodates employees’ diverse needs and contributes to increased job satisfaction and overall well-being.

- Transportation and Commuting: Some employers in Switzerland provide benefits related to transportation and commuting. This may include subsidized public transportation passes, contributions towards commuting expenses, or even initiatives promoting eco-friendly commuting options such as cycling or carpooling.

- Employee Assistance Programs (EAPs): To support employees’ mental and emotional well-being, some employers offer Employee Assistance Programs (EAPs). These programs provide confidential counseling services, assistance with personal issues, and resources to help employees navigate life’s challenges. EAPs contribute to a positive and supportive work environment.

Termination of Employment Procedure in Switzerland

In Switzerland, the termination of employment is governed by various legal and regulatory frameworks, ensuring a fair and transparent process for both employers and employees. Employers must adhere to specific procedures to terminate an employment relationship, taking into account the relevant laws and regulations.

- Notice Period: One of the key elements in the termination process is the notice period. According to Swiss employment law, the length of the notice period depends on the length of service of the employee. It is crucial for employers to provide written notice to the employee, specifying the termination date and the applicable notice period.

- Grounds for Termination: Swiss labor law distinguishes between termination with and without just cause. Termination with just cause is applicable when there is a serious breach of contract by the employee, such as gross misconduct. In cases without just cause, employers must provide a valid reason for termination, such as restructuring or economic reasons.

- Dismissal Protection: Certain categories of employees, such as pregnant women, employees on sick leave, and employee representatives, benefit from special protection against dismissal. Employers must be cautious when terminating the employment of individuals falling under these protected categories, as additional legal requirements and procedures may apply.

- Consultation with Employees: In some cases, especially when collective dismissals are involved, employers are required to engage in a consultation process with the affected employees or their representatives. This process includes providing information about the reasons for termination, exploring alternatives, and discussing potential measures to mitigate the impact on employees.

- Severance Pay: While Swiss law does not mandate severance pay, employers and employees may agree upon it in their employment contracts or during the termination negotiations. Severance pay is typically linked to the length of service and can serve as compensation for the termination of employment.

- Exit Interviews: Conducting exit interviews can be a valuable practice for both employers and employees. It provides an opportunity to discuss the reasons for termination, gather feedback, and address any concerns. This communication can contribute to a smoother transition and help improve the work environment for remaining employees.

- Documentation: Employers should maintain thorough documentation throughout the termination process. This includes records of the termination letter, notice period calculations, any severance agreements, and documentation related to the consultation process. Proper documentation is essential to demonstrate compliance with legal requirements in case of disputes.

- Legal Compliance: Lastly, employers must ensure that the termination process complies with all applicable Swiss employment laws and regulations. Seeking legal advice before initiating the termination procedure can help prevent potential legal challenges and ensure a fair and lawful termination process.

Types of Holidays and Leave Policies in Switzerland

1. Public Holidays:

In Switzerland, public holidays vary from canton to canton, as each region has the autonomy to declare its own holidays. However, some holidays are widely observed throughout the country. These include New Year’s Day, Good Friday, Easter Monday, Labour Day (May 1st), Swiss National Day (August 1st), Federal Day of Thanksgiving, Repentance, and Prayer (usually the third Sunday in September), Christmas Day, and St. Stephen’s Day (December 26th). While these are generally days off for the majority of the population, the specific list may vary depending on the cantonal regulations.

2. Annual Leave:

Switzerland is known for its generous annual leave policies, and the standard vacation entitlement is usually around four to five weeks per year. Employees typically accumulate leave days based on their years of service with a particular employer. It’s common for employees to split their annual leave into smaller segments, allowing for more flexibility in planning vacations throughout the year. Employers usually encourage their staff to take their annual leave to promote work-life balance and overall well-being.

3. Maternity and Paternity Leave:

Switzerland places a strong emphasis on supporting families, and maternity and paternity leave policies reflect this commitment. Maternity leave is generally 14 weeks, with a mandatory eight-week leave following childbirth. Fathers are entitled to paternity leave, typically lasting one to two weeks. Additionally, there are provisions for parental leave, allowing parents to take time off to care for their children during the early years. These policies contribute to a family-friendly work environment and support the overall welfare of employees.

4. Sick Leave:

Switzerland provides comprehensive sick leave policies to ensure that employees can take the necessary time off to recover without compromising their financial stability. Generally, employees are entitled to full salary during sick leave, and the duration of paid sick leave varies based on the employment contract and the specific company policies. Employers may require a medical certificate for extended periods of illness, and the social insurance system may come into play to provide additional support in some cases.

5. Special Leave:

Swiss employment law also recognizes the need for special leave in certain circumstances. This can include compassionate leave for family emergencies, marriage leave, or even time off for important personal events. While the duration and conditions for special leave may vary between employers, Swiss labor laws generally acknowledge the importance of allowing employees time off for significant life events that fall outside the scope of standard vacation or sick leave.

Types of Work Permits and Visas in Switzerland

1. Work Permits in Switzerland: Overview

Switzerland, renowned for its picturesque landscapes and economic stability, has a well-defined system for granting work permits to foreign nationals. The Swiss work permit system is categorized based on factors such as nationality, the duration of stay, and the type of employment. The primary types of work permits include short-term permits, long-term permits, and permits for EU/EFTA nationals.

2. Short-Term Work Permits

Short-term work permits in Switzerland are typically granted for stays lasting up to 90 days. These permits are suitable for individuals engaged in temporary assignments, business meetings, or short-term projects. The application process for short-term permits is relatively streamlined, requiring documentation such as proof of employment, a valid passport, and confirmation of accommodation.

3. Long-Term Work Permits

For individuals planning to work in Switzerland for a period exceeding 90 days, long-term work permits are essential. The issuance of long-term permits is subject to stricter criteria, including proof of a valid employment contract, qualifications, and sometimes labor market considerations. Non-EU/EFTA nationals often need to secure a job offer before applying for a long-term work permit.

4. EU/EFTA Nationals: Free Movement Agreement

Citizens of European Union (EU) and European Free Trade Association (EFTA) member states benefit from the Free Movement Agreement, allowing them to work in Switzerland without a specific work permit. However, they may still need to register their residence with the local authorities. The agreement facilitates the seamless movement of workers across member countries, fostering economic integration.

5. L Permits for Short-Term Assignments

Switzerland issues L permits for short-term assignments, commonly for a duration of up to one year. These permits are granted to individuals who work in Switzerland but maintain their primary residence in another country. L permits may be renewable, but their issuance is subject to the approval of the Swiss authorities, and certain conditions, such as salary thresholds, must be met.

6. B Permits for Long-Term Residence

B permits are issued for long-term residence and employment in Switzerland. Non-EU/EFTA nationals often need a B permit, and its issuance is contingent on factors like a secure job offer, appropriate qualifications, and compliance with salary requirements. B permits are typically renewed annually and can lead to permanent residency status after several years of continuous residence.

7. C Permits for Permanent Residency

C permits signify permanent residency in Switzerland. After a certain period of residing and working in the country, individuals with a B permit may be eligible to apply for a C permit. This status grants them the right to reside in Switzerland indefinitely, enjoying the same rights as Swiss nationals, including access to social benefits and public services.

Background Checks on Switzerland Employees

Background checks on employees in Switzerland are a meticulous process designed to maintain the country’s high standards of professionalism and reliability. Here are the key aspects of background checks on employees in Switzerland.

- Legal Framework: Switzerland has strict regulations governing employee privacy, and any background checks must adhere to these laws. The Federal Act on Data Protection (FADP) outlines the principles for processing personal data, ensuring that individuals’ rights are respected. Employers must obtain consent from the candidate before conducting background checks and are only permitted to gather information directly relevant to the job position.

- Criminal Record Checks: Criminal record checks are a common component of background checks in Switzerland. Employers may request a candidate’s criminal history, particularly for positions that involve handling sensitive information or financial responsibilities. However, it is essential to note that certain convictions may be deemed irrelevant, and decisions should be based on the specific requirements of the job.

- Financial Background Checks: In the financial sector or roles involving fiduciary responsibilities, employers often conduct financial background checks. This may include scrutinizing a candidate’s credit history to assess their financial stability and responsibility. Such checks are typically conducted with the candidate’s explicit consent and in line with the principles of necessity and relevance.

- Educational and Professional Verification: Ensuring the accuracy of a candidate’s educational and professional background is paramount in Switzerland. Employers may verify academic credentials, professional certifications, and previous employment history to confirm the accuracy of the information provided by the candidate. This verification process helps maintain the high standards of professionalism and competence expected in the Swiss workforce.

- Reference Checks: Reference checks are a standard part of the background screening process in Switzerland. Employers often contact previous employers or professional references to gather insights into a candidate’s work ethic, skills, and overall suitability for the role. While reference checks are crucial, they must be conducted with sensitivity to privacy regulations.

- Social Media Screening: As in many other countries, social media screening has become increasingly common in Switzerland. Employers may review a candidate’s publicly available online presence to gain additional insights into their character and behavior. However, it’s crucial to strike a balance between obtaining relevant information and respecting the candidate’s right to privacy.

Most Important Recruitment Tools in Switzerland

- Job Boards and Portals: In Switzerland, job boards and online portals play a crucial role in recruitment. Platforms such as JobScout24, Indeed, and Monster are widely used by both employers and job seekers. These platforms provide a centralized space for posting job openings and allow candidates to search for opportunities based on various criteria such as industry, location, and job type. Swiss employers often leverage these tools to reach a broad audience and efficiently manage the initial stages of the recruitment process.

- Applicant Tracking Systems (ATS): Applicant Tracking Systems are widely adopted by Swiss companies to streamline the recruitment workflow. Tools like Taleo, Workday, and Jobvite are designed to automate the hiring process, from posting job listings to managing resumes and communications with candidates. These systems help recruiters and HR professionals efficiently manage large volumes of applications, track the progress of candidates, and collaborate seamlessly with team members involved in the hiring process.

- Professional Networking Platforms: Professional networking platforms like LinkedIn are extensively used for recruitment in Switzerland. These platforms facilitate direct interaction between employers and potential candidates. Recruiters can not only post job openings but also actively search for and connect with professionals whose profiles align with their hiring needs. The ability to showcase company culture, employee testimonials, and other relevant information on these platforms enhances the employer branding efforts, making them essential tools in the Swiss recruitment landscape.

- Recruitment Agencies: Recruitment agencies are instrumental in connecting employers with suitable candidates in Switzerland. These agencies often specialize in specific industries or job sectors, providing expertise and a deep understanding of the local labor market. Employers often rely on these agencies to access a pool of pre-screened and qualified candidates, saving time and resources in the hiring process. Popular recruitment agencies in Switzerland include Adecco, Randstad, and Manpower.

- Skills Assessment and Testing Tools: Ensuring that candidates possess the necessary skills is crucial for the Swiss recruitment process. Skills assessment and testing tools like Codility, HackerRank, and Mercer Mettl help in evaluating candidates’ technical, cognitive, and behavioral competencies. These tools assist recruiters in making informed decisions, ensuring that candidates not only meet the educational and experiential requirements but also possess the specific skills required for the job.

- Video Interviewing Platforms: Especially in a globalized job market, video interviewing platforms have become increasingly important in Switzerland. Tools like HireVue and Spark Hire allow recruiters to conduct remote interviews efficiently, enabling them to connect with candidates regardless of geographical locations. Video interviews also contribute to a more inclusive hiring process, accommodating candidates who may not be able to attend in-person interviews due to various constraints.

Why Hiring Talents in Switzerland?

Hiring talents in Switzerland offers a unique blend of a highly skilled workforce, innovation, linguistic diversity, stability, quality of life, and global connectivity. These factors make Switzerland an attractive destination for companies aiming to secure top-notch professionals in an environment that promotes both professional and personal success.

- Highly Skilled Workforce: Switzerland boasts a reputation for maintaining an exceptionally skilled workforce. The country places a strong emphasis on education, and its universities consistently rank among the best globally. This commitment to education ensures a steady stream of highly qualified professionals in various fields, making it an attractive destination for companies seeking top-tier talent.

- Innovation Hub: Switzerland is renowned for its innovation and research capabilities. The country invests heavily in research and development, fostering a culture of creativity and technological advancement. Hiring talents in Switzerland means tapping into a pool of individuals who are not only well-educated but also inclined towards innovative thinking. This makes the country a prime location for companies looking to stay at the forefront of technological and scientific advancements.

- Multilingual Workforce: Switzerland’s multilingual environment is a significant asset for businesses with global operations. The country has four official languages—German, French, Italian, and Romansh—reflecting its diverse cultural landscape. This linguistic diversity creates a workforce with strong communication skills, making it easier for companies to navigate international markets and engage with clients and partners from different linguistic backgrounds.

- Stable Political and Economic Environment: Switzerland is known for its stability, both politically and economically. The country has a long-standing tradition of political neutrality and a well-established legal system, providing a secure and predictable business environment. This stability is particularly appealing to companies looking for a reliable base to conduct their operations without the uncertainties often associated with less stable regions.

- Quality of Life: Switzerland consistently ranks high in global quality of life indices. Its picturesque landscapes, efficient public services, and strong social welfare system contribute to a high standard of living. Offering an excellent work-life balance, the country attracts top talents who prioritize a fulfilling personal life alongside their professional careers. This, in turn, enhances employee satisfaction and productivity.

- Global Connectivity: Switzerland’s central location in Europe makes it a hub for international business. The country’s well-developed infrastructure, including a world-class transportation system and modern communication networks, facilitates easy connectivity with major European cities. This strategic geographical position is advantageous for companies seeking a base that allows them to efficiently reach markets across Europe and beyond.

Which Jobs Are in Demand in Switzerland?

Switzerland’s diverse economy and commitment to excellence in various sectors create a broad range of job opportunities. Skilled professionals in IT, healthcare, finance, engineering, hospitality, renewable energy, and education are particularly sought after in this thriving European nation.

- Information Technology (IT) Professionals: Switzerland has a growing demand for skilled IT professionals across various domains. With the country’s emphasis on innovation and technology, there is a particular need for software developers, data scientists, cybersecurity experts, and IT consultants. Swiss cities like Zurich and Geneva host numerous multinational tech companies, contributing to the high demand for IT talent.

- Healthcare and Life Sciences: The healthcare sector in Switzerland is robust, and the demand for professionals in this field continues to rise. Skilled healthcare workers, including doctors, nurses, pharmacists, and medical researchers, are in demand. The country’s commitment to maintaining a high standard of healthcare, coupled with an aging population, contributes to the sustained need for healthcare professionals.

- Finance and Banking: Switzerland, with its renowned banking sector and financial stability, continues to seek skilled professionals in finance and banking. Roles such as financial analysts, risk managers, investment bankers, and wealth managers are consistently in demand. Cities like Zurich and Geneva are major global financial hubs, attracting international talent to contribute to the country’s financial success.

- Engineering and Manufacturing: The Swiss economy places a significant emphasis on precision manufacturing and engineering. Professionals in fields like mechanical engineering, electrical engineering, and manufacturing processes are highly sought after. The demand is not only driven by domestic industries but also by the export-oriented nature of the Swiss economy, which relies on high-quality manufacturing.

- Hospitality and Tourism: Switzerland’s breathtaking landscapes and well-established tourism industry create a demand for hospitality professionals. Skilled individuals in hotel management, tourism marketing, and event planning are sought after to cater to the needs of the growing number of tourists visiting the country. Cities like Zurich and Lucerne, along with popular tourist destinations in the Swiss Alps, offer numerous opportunities in this sector.

- Renewable Energy and Environmental Sciences: With a strong commitment to sustainability and environmental conservation, Switzerland is increasingly focusing on renewable energy and green technologies. Professionals in renewable energy, environmental sciences, and sustainable development are in demand. The country’s efforts to transition to clean energy sources create opportunities for experts in these fields.

- Education and Research: Switzerland is renowned for its high-quality education system and world-class research institutions. Consequently, there is a continuous demand for skilled educators, researchers, and academic professionals. The country’s commitment to maintaining excellence in education and research ensures a steady demand for individuals contributing to these fields.

The Cost of Hiring Employees in Switzerland

Hiring employees in Switzerland involves a combination of high salaries, mandatory contributions to social security programs, administrative expenses related to work permits, various employment taxes, health insurance costs, and investments in training and development. While the Swiss labor market offers a highly skilled and productive workforce, employers should be prepared for the associated costs that come with recruiting and maintaining talent in this prosperous and competitive environment.

- Salary and Benefits: In Switzerland, one of the key factors contributing to the cost of hiring employees is the relatively high salary standards. The country is known for its robust economy and high living standards, leading to competitive salaries. Additionally, employers are required to provide various benefits, such as health insurance, pension contributions, and mandatory social security payments. These benefits contribute significantly to the overall compensation package, increasing the cost of hiring employees in Switzerland.

- Social Security Contributions: Switzerland has a well-established social security system that includes old-age, survivors, and disability insurance (OASI/DI), as well as unemployment insurance (UI). Employers are required to make contributions to these programs, further adding to the overall cost of hiring. The social security contributions are calculated based on the employee’s salary, and the rates can vary depending on the canton and municipality.

- Work Permits and Administrative Costs: Employers in Switzerland may incur additional costs related to work permits and administrative procedures when hiring foreign nationals. The process of obtaining work permits for non-EU/EFTA citizens can be complex and may involve various fees. Employers often need to navigate through bureaucratic requirements, and engaging legal or immigration experts to facilitate the process may add to the overall cost.

- Employment Taxes: In addition to social security contributions, employers are subject to various employment taxes in Switzerland. These taxes may include cantonal and municipal taxes, as well as federal taxes. The complexity of the Swiss tax system and the variation in tax rates among different regions contribute to the overall cost of hiring employees. Employers must carefully consider these tax obligations when budgeting for new hires.

- Health Insurance Costs: Health insurance is mandatory for all residents in Switzerland, including employees. While employers are not required to provide health insurance directly, they often contribute to the cost. The health insurance premiums can vary based on factors such as age, health condition, and the chosen insurance plan. Including health insurance as part of the employment package significantly impacts the overall cost for employers.

- Training and Development: Switzerland places a strong emphasis on education and skills development. Employers may need to invest in training programs to ensure that employees have the necessary skills and knowledge. While this is an investment in the long-term success of the workforce, it does contribute to the upfront cost of hiring. Companies must consider ongoing training and development expenses to maintain a skilled and competitive workforce.

How to Use an Employer of Record (EOR) in Switzerland?

Using an Employer of Record (EOR) in Switzerland can be a strategic and efficient solution for businesses looking to expand their operations in the country. An EOR is a third-party entity that assumes the responsibility of being the official employer for your workforce in a foreign country, handling legal, administrative, and compliance matters. Here’s a guide on how to effectively use an EOR in Switzerland.

Firstly, identify your business needs and objectives for expansion in Switzerland. Determine the scope and duration of your operations, as this will influence the type of EOR services required. Once you have a clear understanding of your goals, start researching and selecting a reputable EOR provider with expertise in Switzerland’s employment regulations and practices.

Next, establish a contractual relationship with the chosen EOR. This typically involves signing a service agreement that outlines the terms, responsibilities, and costs associated with the employment services. Make sure to clarify the scope of services provided, including payroll processing, tax compliance, benefits administration, and legal compliance with Swiss labor laws.

Collaborate closely with the EOR to provide all necessary information about your employees, including contracts, salary details, and relevant personal information. The EOR will use this data to ensure that your workforce is legally compliant with Swiss employment regulations, tax laws, and social security requirements.

Once the EOR has taken over the employer responsibilities, they will handle tasks such as payroll processing, tax withholding, and compliance with Swiss employment laws. This allows your business to focus on its core activities without getting bogged down by the intricacies of local employment regulations.

Maintain open communication with the EOR to stay informed about any changes in Swiss employment laws or regulations that may impact your business. Regularly review the services provided by the EOR to ensure they align with your business needs and compliance requirements.

Finally, if your business operations evolve or if you decide to establish a legal entity in Switzerland, work with the EOR to smoothly transition the employment responsibilities. Whether expanding your workforce or scaling down operations, the EOR can adapt to your changing needs, providing flexibility and efficiency throughout your business journey in Switzerland.

Read More Hiring Guides: