Benefits of Conducting HR Audits

The word “audit” can strike fear in the most seasoned Human Resources (HR) professional as it can be intimidating, disruptive, and cause undue anxiety. Generally, HR audits do more than keep organizations on the right side of regulations—they also contribute to a stronger, more engaged workforce. Regular HR audits allow organizations to identify and mitigate potential risks before they escalate, strengthen existing policies, and enhance the culture of the overall workplace. Some may view audits as unnecessary or burdensome, especially if the reasons behind them are not clearly understood. This creates internal resistance, making the process more stressful for everyone involved.

It is difficult to measure the value of an organization that is confident in its compliance efforts and not awaiting a costly surprise from a regulatory agency. By working proactively and flagging potential issues early, such as wage misclassifications or outdated protocols, HR audits help to minimize the risk of legal complications. Additionally, they enable companies to focus on optimizing processes and creating more efficient and transparent systems, which can boost employee trust and morale.

For employees, the indirect benefits are also significant. An organization committed to proactive HR audits shows its workforce that it values a fair and lawful environment. This transparency can help cultivate a culture of trust, leading to boosts in productivity and greater increases in morale. Furthermore, organizations that prioritize compliance often have stronger reputations, which can attract top-tier talent in competitive job markets. In this blog, we concentrate on two main types of HR audits: the Fair Labor Standards Act (FLSA) Audits and general HR Compliance Audits.

FLSA Audits

The Fair Labor Standards Act (FLSA) serves as the foundation of wage and hour laws in the United States, establishing essential guidelines around minimum wage, overtime pay, and other quintessential aspects of labor rights. FLSA audits are focused on ensuring that these regulations are adhered to, and, more importantly, that organizations avoid serious non-compliance penalties. For HR departments and business leaders alike, conducting these audits helps to provide a clear path toward better pay practices and fair treatment in the workplace.

The main goal of an FLSA audit is simple but important: verify compliance with wage and hour regulations to protect both the company and its employees. To do this successfully, companies are recommended to undergo a detailed process that often includes the following steps:

- Preparing for the Audit: Organizations are encouraged to review employee information and gather all necessary documents. In an FLSA audit, of most importance, is the job descriptions or position description questionnaires that define each position’s roles and responsibilities.

- Reviewing Employee Classifications: To determine if an employee is exempt or non-exempt under the Fair Labor Standards Act (FLSA), it is imperative to assess the job duties, as listed in the job description, salary level, and payment structure. While there are many “rules” that define an employee’s classification, a basic rule of thumb includes:

- Exempt employees typically perform executive, administrative, or professional roles, are paid on a salary basis, and earn above a specific threshold (e.g., $844/week as of July 1, 2024). These employees are exempt from overtime pay.

- Non-exempt employees are eligible for overtime pay, beyond a certain number of hours, and are usually paid hourly, regardless of their job type. Non-exempt employees typically perform routine tasks and have limited decision-making responsibilities.

- Analyzing Payroll Records and Salary Information: Reviewing payroll records for accuracy and to determine if salary thresholds are met guarantees that employees are compensated according to federal, state, and company standards.

- Assessing Overtime Calculations: FLSA mandates specific rules on overtime pay. A careful review ensures employees receive fair compensation for their extra hours.

One of the more frequent FLSA issues is the misclassification of an employee’s exemption status, where an employee who should be eligible for overtime is mistakenly labeled “exempt.” Any violation can become very expensive very quickly as violations are calculated on a per-violation basis. In addition, minor errors in payroll calculations can quickly snowball, creating further liabilities.

HR Compliance Audits

Similar to FLSA Audits, but broader in scope, is an HR Compliance Audit. The purpose of an HR Compliance audit is to ascertain the level of alignment and adherence to all applicable local state and federal regulations as well as a review of all employment-related company policies and practices. Typically, a compliance audit will be completed through a series of employee interviews (HR employees and others) and a comprehensive review of current HR documentation, tools, and practices to assess areas of inconsistency and inefficiency, identify gaps and vulnerabilities, and develop recommendations for improvements.

Whether an audit is conducted internally or externally, the first phase of an HR Compliance Audit typically starts with reviewing pertinent documentation and assessing HR processes. Items to be addressed may include:

|

Federal Employment Laws |

Policies & Procedures |

|

Equal Employment Opportunity (EEO) |

Performance Management |

|

Americans with Disabilities Act (ADA) |

Discipline Procedures & Documentation |

|

Employee Retirement Income Security Act (ERISA) |

Employee Files/Records |

|

Family Medical Leave Act (FMLA) |

Workplace Harassment /Sexual Harassment |

|

Employment Eligibility Verification (I-9 Forms) |

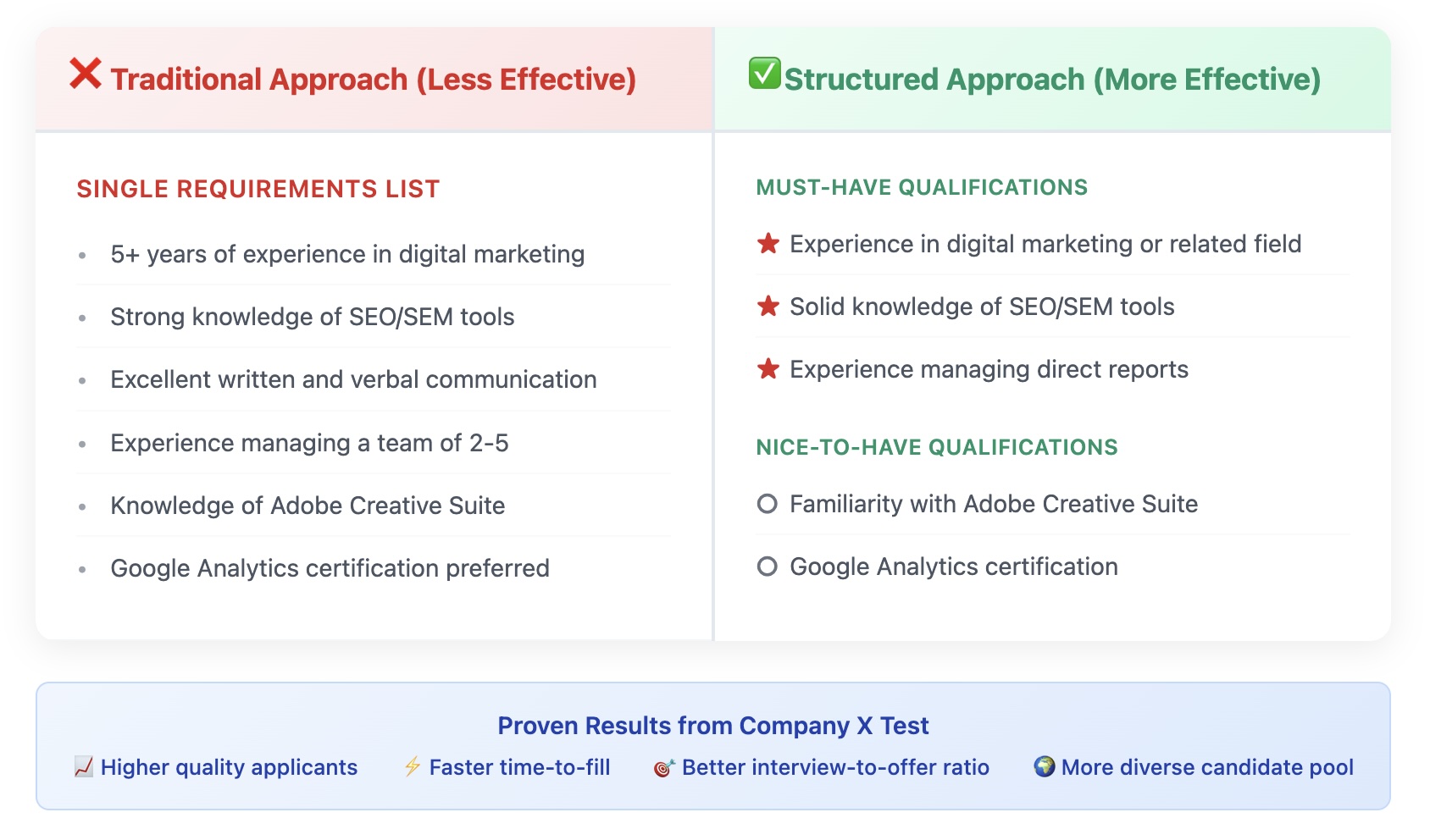

Staffing & Selection |

|

Consolidated Omnibus Budget Reconciliation Act (COBRA) |

Wage and hour laws |

As a result of the audit process, if gaps are identified, a corrective action plan must be developed and prioritized. Prioritization should be determined based on the overall risk(s) to the organization. FLSA misclassifications would be considered a high-priority item for the reasons previously stated. Other post-audit activities include documenting the audit process and associated findings, communicating with leadership and other stakeholders, monitoring progress toward improvements whether they be compliance-related or efficiency improvements, updating policies and procedures, and providing training to the HR team, management, or others to address non-compliance or gaps in understanding.

Consequences of Non-compliance

The consequences of non-compliance in any of the areas that have been discussed range from penalties or fines from various state and federal regulatory agencies to significant reputational damage. Both of which can be hard to recover from in an increasingly transparent employment landscape. In turn, being proactive toward audits is an investment in both compliance and brand integrity.

Conclusion

In today’s complex legal landscape, both FLSA and HR compliance audits are critical for organizations that want to stay ahead of regulatory challenges and orchestrate a fair workplace. Conducting regular audits reduces risks, strengthens trust within the workforce, and helps to foster a culture of integrity and compliance. For organizations committed to upholding compliance and integrity, regular audits are a powerful step toward ensuring that company practices align with regulatory standards and support employee well-being. Strengthening your approach to compliance fosters a workplace that reflects your values, builds a foundation of trust and fairness across the organization, and overall promotes good business.