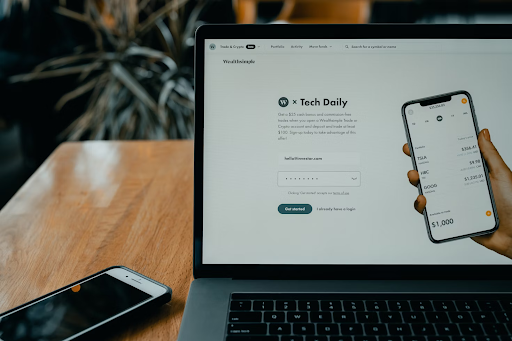

Mobile apps are making the world so much more convenient. Can you imagine having an app that allows quick access to the financial world? With fintech apps, you can access your portfolio from anywhere at any time, which marks a massive change in how we invest. In 2024, these solutions will be crucial for daily financial management. Therefore, companies build fintech apps that provide many opportunities for users.

The Fintech market

The market is dynamic, given changing customer needs and technological innovations. The goal is to provide efficiency and convenience with modern solutions. Apps dedicated to investing, savings, peer-to-peer payments, and mobile banking make ordinary tasks much easier.

It is impressive to know that fintech apps will cover 5% of the banking revenue in 2022, a trend that will continue to grow in the upcoming years. The app development companies are striving to change how the financial sector works.

The fintech app market is highly competitive and requires not only fresh ideas but also market analysis. If a company wants to be part of this sector, it needs to identify market gaps and understand users, their needs, and competitors. This allows them to create apps that solve users’ problems and are ahead of the competition.

Regulatory changes in the fintech market

Regulative changes shape the fintech market. They can impact it in two ways: driving innovation or imposing challenges. For example, in Europe, the GDPR imposes data protection, and PSD2 regulates payment services. The situation is similar in the US, where the Dodd-Frank Act focuses on protecting the customer. The legal framework is meant to provide a secure transaction process, stimulating innovation while protecting customer rights.

The app development companies already have experience with legal work, so they can help navigate the challenges and promote growth.

Adapting to new changes quickly is critical to success in this sector. The legal framework can change, so only agile companies that respond swiftly will thrive in the dynamic market.

Trends for 2024

Fintech market growth

The fintech market experiences immense growth powered by customer demand for mobile services, legal regulations that support the sector, and technological advancements. In 2017, this industry had a revenue of 80 billion euros. In 2024, it will reach a staggering 188 billion euros.

Digital banking

The finance world is shifting toward digital services to provide convenience and efficiency. Traditional banking is obsolete; digital and neo-banking are taking over the financial landscape.

This means higher demand for banking services for the fintech sector. Companies will cater to the market, developing innovative solutions that suit user needs.

Personalized dashboards and seamless payment

The fintech sector focuses on streamlining the financial processes and removing the hassles. They tend to simplify the payment process and enhance security. This trend changes how financial services are delivered.

User-friendly design

Companies are focused on creating user-friendly designs according to customers’ needs. Companies that cater to a diverse range of users implement easy accessibility, allowing easy use for those with disabilities.

Technology integration

Machine learning, blockchain, and artificial intelligence are some of the latest technologies implemented across various industries. In the fintech sector, they help improve the user experience and enhance security. Blockchain technology implements a smart contract that completes the transactions according to the predefined conditions, which reduces the need for manual tasks and improves security. AI integration in chatbots can help deliver personalized finance tips for users.